Find the right automation solutions for your manufacturing

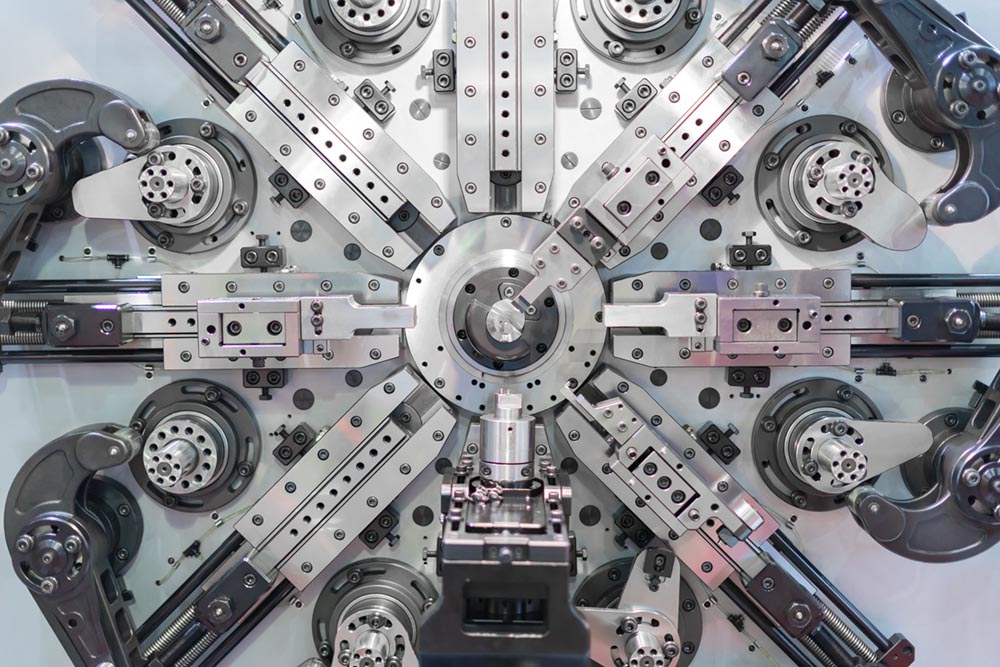

Turn-key tailor-made high-performance automation solutions that redefine manufacturing productivity and quality standards.

Who we are

Founded in 2005 with a vision to create inspired and innovative automation solutions that revolutionize manufacturing productivity and quality. Innomation is well known for developing customized solutions for the most complex processing and packaging challenges.

Our solutions are built for round-the-clock operation with minimal maintenance requirements and are known for their quick change-over, flexibility, speed, and robust design.

Why choose us

We are focused on making your process a success

Our automation solutions are custom built to suit real-time production conditions at your factory. With in-depth focus on identifying, quantifying and mitigating real time process and manpower variables, our automation solutions stand apart when it comes to performance and reliability.

Our Services

Innomation offers state of the art processing and packaging automation solutions. Our R&D team, with multiple global patents can design and deploy automation solutions for virtually any application.

OEE Enhancement

Solutions

Automation solutions that help you maximize your Overall Equipment Effectiveness to meet or exceed global standards.

Need automation solutions that take your productivity to the next level?

How we do it

Decades of R&D experience across multiple sectors has enabled us to fine-tune our automation development process and ensure our projects meet and exceed client expectations throughout the equipment lifecycle.

From Our Clients

Innomation is capable & they very well manage conceptualizing, manufacturing and installing of the machine. Great support was provided with good amount of hard work and sincerity.

At last magic is working. We are pleased to inform you the Magic created by you to be happening here. The production was unimaginable after seeing the trials results and the tough time you had with the cubes. Hope this dream lasts forever.

Our Recent Projects

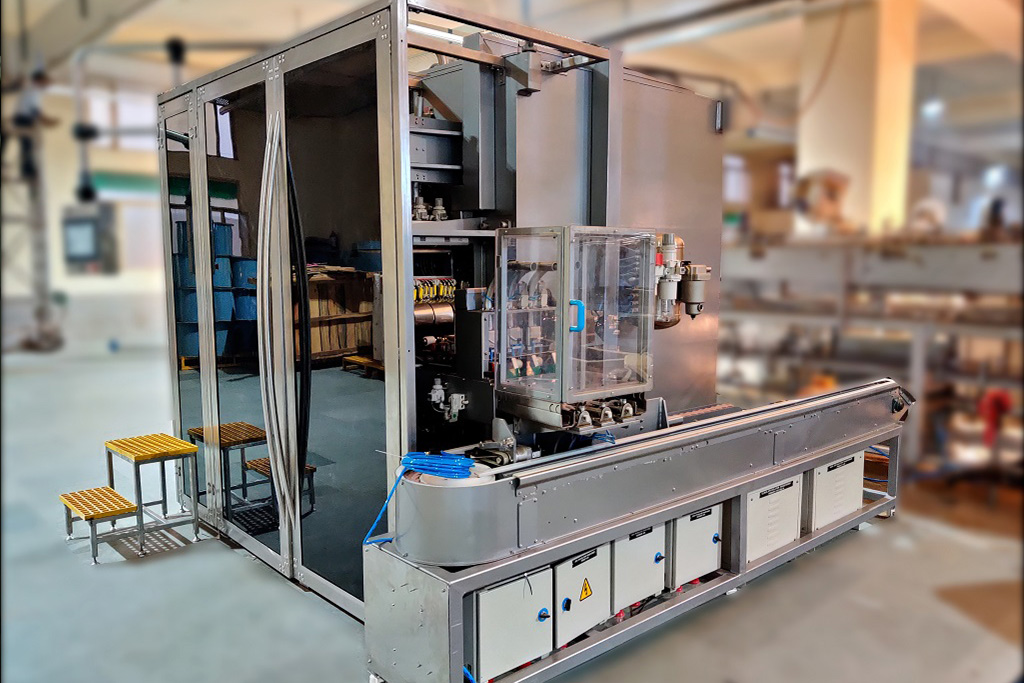

InnoVAC INDIE

Sachet Packaging

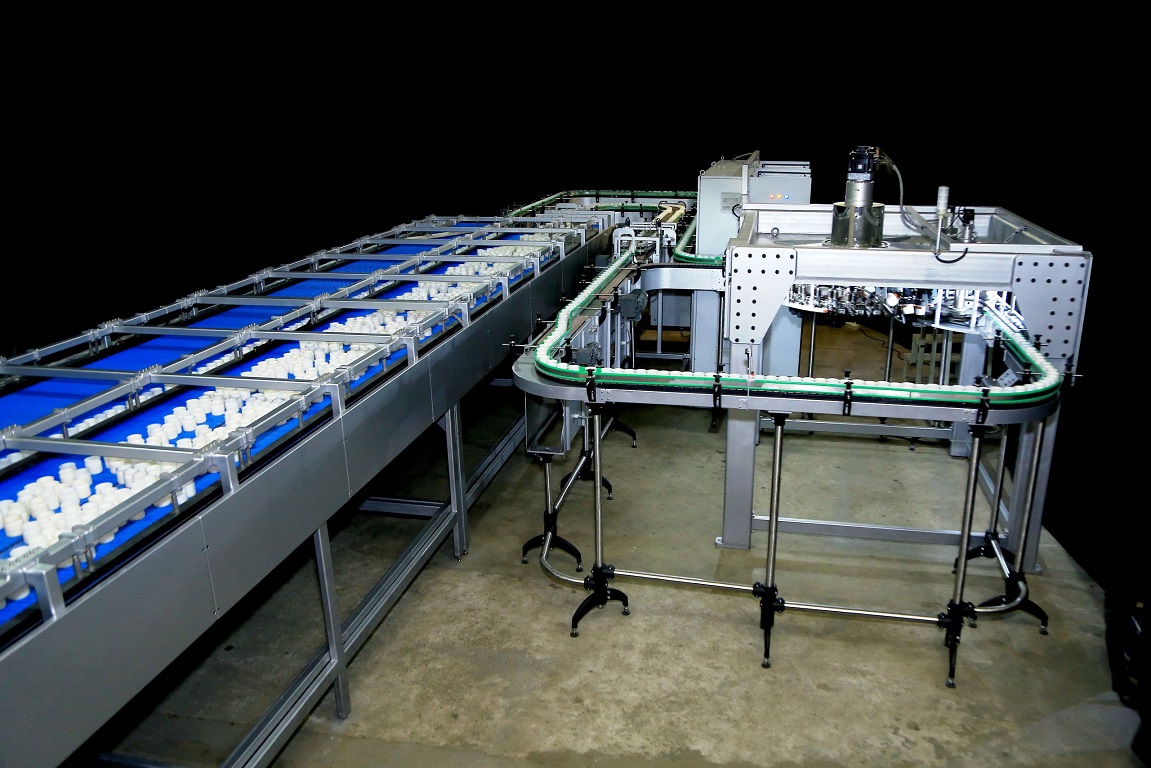

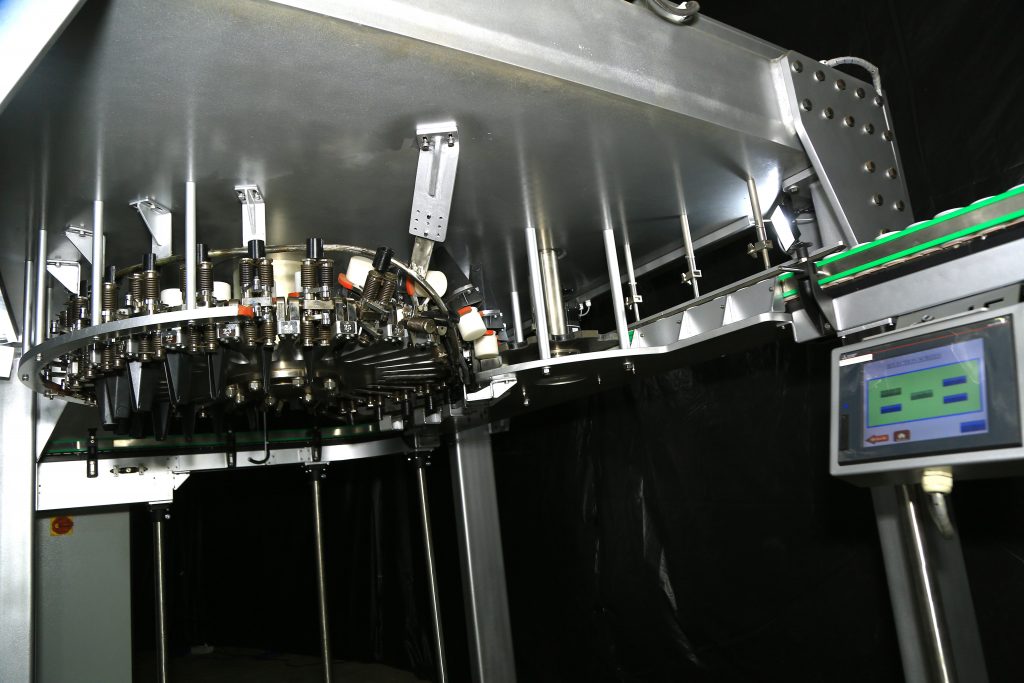

Specialized Conveying Systems

Specialized Conveying Systems

Specialized Conveying Systems